Dear Investors:

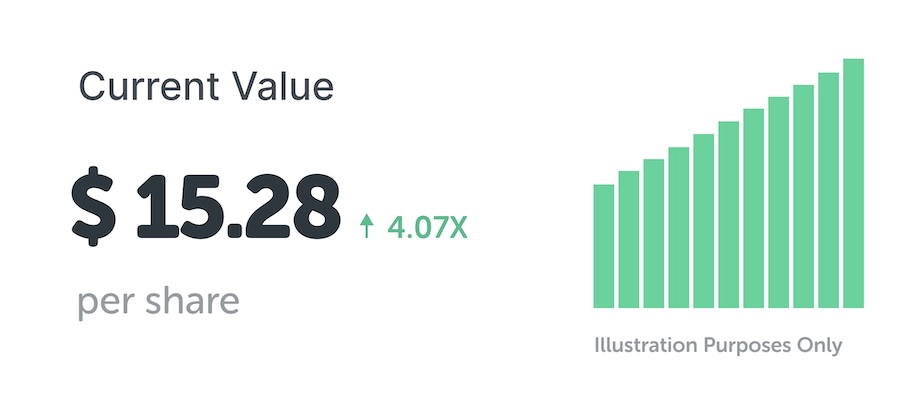

Generation Genius is pleased to present you with an opportunity to realize a return on your investment. The company is initiating a stock buyback program, offering a 4.07x return on a first-come, first-served basis. Below, we’ve outlined key details, including the timeframe, maximum buyback volume, and the rationale behind this decision.

1. Discontinuation of the science kit product line.

In 2022, we launched subscription-box science kits and have since sold over 100,000 units, generating revenue exceeding $4.5 million. Despite these sales, the operation has been incurring substantial losses each month, totaling a $5.6 million loss to date. Given the improbable prospect of a turnaround, we have decided to discontinue this part of our business and redirect our focus.

2. Update on the EdTech industry.

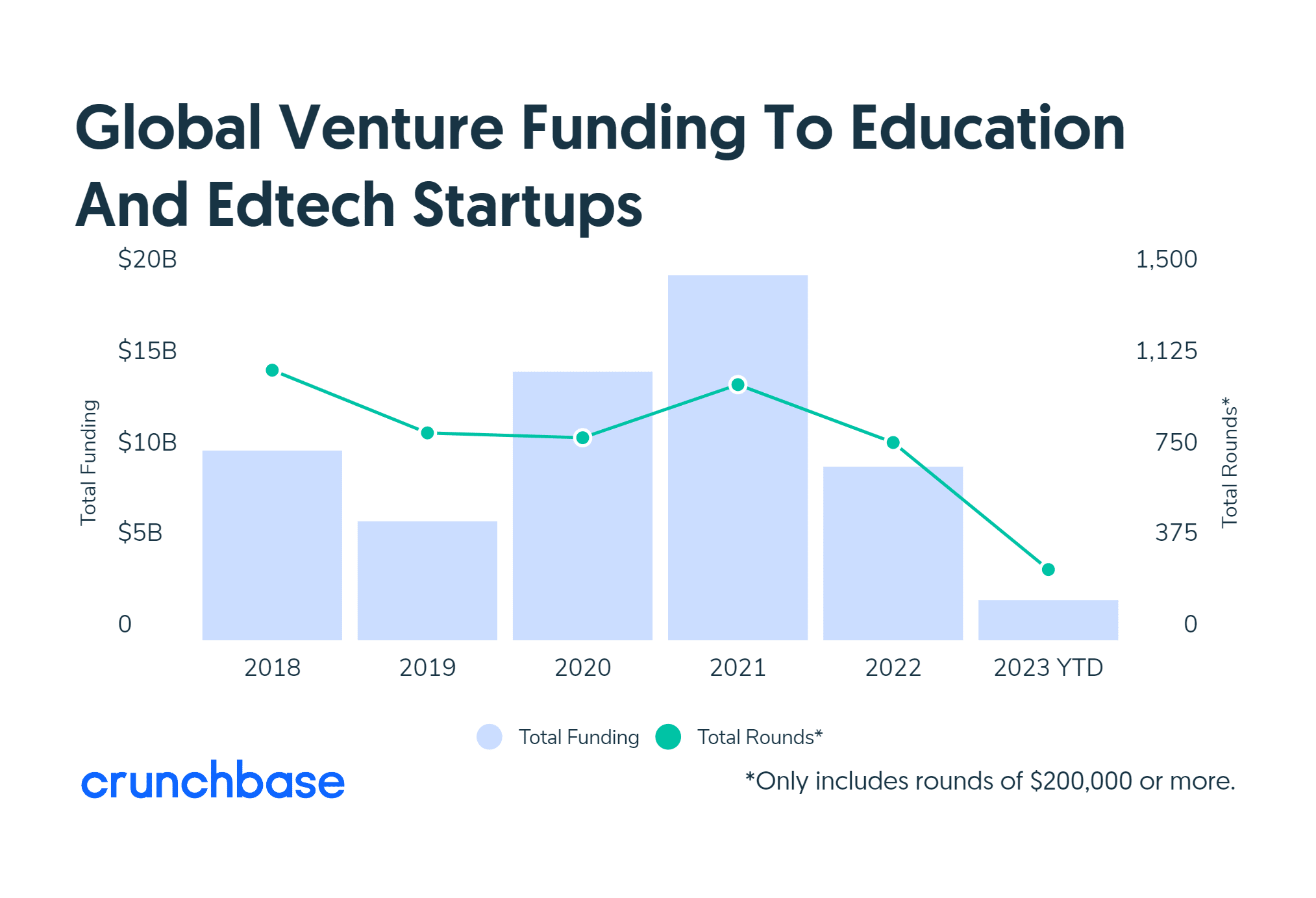

The EdTech industry has seen a major contraction in valuations and deal volume post-pandemic. According to a Crunchbase News article published on Aug 9, 2023, venture funding in EdTech is down 89% compared to 2021. Not a single EdTech company globally has raised a round of $100+ million in 2023, while in 2021 and 2022 there were 60 such rounds. A graph from the article is displayed below. You can read the full Crunchbase article here. M&A activity in EdTech shows a similar trend.

In 2023, the most valuable EdTech startup in the world, Byju’s, once worth $22 billion lost more than 80% of its value after defaulting on a $1.2B loan.

In the backdrop of these market conditions, we engaged an investment bank in 2023 to facilitate confidential discussions with private equity firms and potential acquirers in this space. Unfortunately, the responses were not favorable and none of the 100+ discussions materialized into a binding proposal. At this time we have no discussions on the table.

3. Founder participation in the buyback.

In the spirit of transparency, we would like to inform you that the founders and related shareholders plan to participate in this buyback at the same exact terms ($15.28/share), but with certain limitations. Founders & related shareholders are subject to a selling cap of 20% of their shares and will only be able to sell their shares after an initial 7-day window, ensuring all other shareholders have the opportunity to participate.

Founder & CEO Jeff Vinokur has indicated his non-binding intention to sell 313,333 shares in this offer for $4,787,728.24. President and Director Eric S. Rollman has indicated his non-binding intention to sell 126,666 shares in this offer for $1,935,456.48. Oleg Vinokur (relative of Jeffrey Vinokur) has indicated his non-binding intention to sell 20,000 shares in this offer for $305,605.00.

4. How does this stock buyback work?

Any shareholder can sell their shares back to Generation Genius for $15.28 per share, only between Jan 2 – Jan 26 2024, on a first-come first-served basis. Once we have bought back $9,000,000 worth of shares, we do not anticipate buying back any more.

5. Do I have to sell my shares?

Selling shares is voluntary; you do not have to sell. If you do not sell your shares, please understand that: (1) there may never be another opportunity to sell your shares, (2) the shares could lose all value in the future, (3) we have satisfied our reporting requirement with the SEC and (4) we no longer send quarterly updates by email, but will continue to share worthy news and announcements with our shareholders.

6. What is the valuation?

The StartEngine round in 2019 was conducted at $3.75 per share. The buyback in 2021 was conducted at $7.50 per share. This current buyback is being conducted at $15.28 per share. This means the current price with respect to shares bought during the crowdfunding campaign has increased 4.07x. So if you invested $500, then you can sell your shares back to us for $2,035. The valuation was set internally based on comparisons to our previous share prices, the market conditions of EdTech, as well as taking into consideration our cash on hand to be able to conduct this buyback. We are not required to obtain an independent valuation. The share price is calculated by dividing a $40,000,000 valuation by the total number of shares.

7. What are the steps to sell my shares?

Enter the email associated with your StartEngine account above. This will show you the amount you will receive for selling your shares. To sell, simply fill in the information requested, and click “Sell Shares.” A paper check will be mailed within 10 business days of Jan 26th. There is no fee to sell and this offer is to sell all your shares or none of them. If you have any questions you can email [email protected].

8. How will the company operate going forward?

Both Dr. Jeff Vinokur and Eric S. Rollman intend to remain with the company to operate it and continue efforts to build value. By holding onto your shares, you are continuing to believe in management’s ability to execute.

We initially aimed for growth leading to acquisition within 5-7 years. We delivered growth every year, unfortunately, the reality of the EdTech market’s downturn has prompted a reassessment.

Growth is now anticipated to be more gradual, and the path to a potential acquisition is less clear. Consider the varying trajectories of companies similar to ours: BrainPOP took 23 years to be acquired, Flocabulary was acquired after 15 years, and Mystery Science in 6 years. Yet some, like Mosa Mack Science, continue independently. These examples illustrate the unpredictable nature of acquisition timelines in our industry.

9. Is the amount I receive for my shares in the stock buyback taxable?

We are not qualified to give tax advice. Each person’s tax situation is different. We recommend you consult your tax advisor prior to accepting our offer.

10. Where can I get more details about this offer?

Please download this “Offer to Purchase” document which includes all details of the offer as well as financial statements for Jan 1 – Sep 30 2023 appended to the end of it.